Nothing accelerates the development of new technologies like money and competition. The modern space race is a vivid example of how several millionaires fight for the championship. In 2020 SpaceX, owned by Elon Musk, became the first private company to send people into orbit. Soon after this, Richard Branson’s Virgin Galactic and Jeff Bezos’ Blue Origin made suborbital flights. Their efforts made it possible to reduce costs and open a new era of space activity. Space is now more accessible than ever.

The era of private space

The first market space operations began after the launch of the transatlantic communications satellite Telstar 1. The US government passed the Communications Satellite Act of 1962, which gave private companies the right to own and operate commercial satellites. The following important stages of development include the Commercial Space Launch Act of 1984, expanding mandate of US Commercial Space Transport Administration, and the US Commercial Space Launch Competitiveness Act of 2015, aimed at encouraging commercial space exploration and exploitation.

Such gradual deregulation in the United States has led to a huge growth of private initiatives. In 15 years, the scope of commercial activity has more than tripled, increasing from 110 billion dollars in 2005 to almost 357 billion dollars in 2020. According to the Space Foundation study, the value of the global space economy in 2020 reached 424 billion dollars, having increased by 70% since 2010. According to forecasts by Morgan Stanley, by 2040 the annual revenue of the space industry may exceed a trillion dollars.

1. Cost of space flight

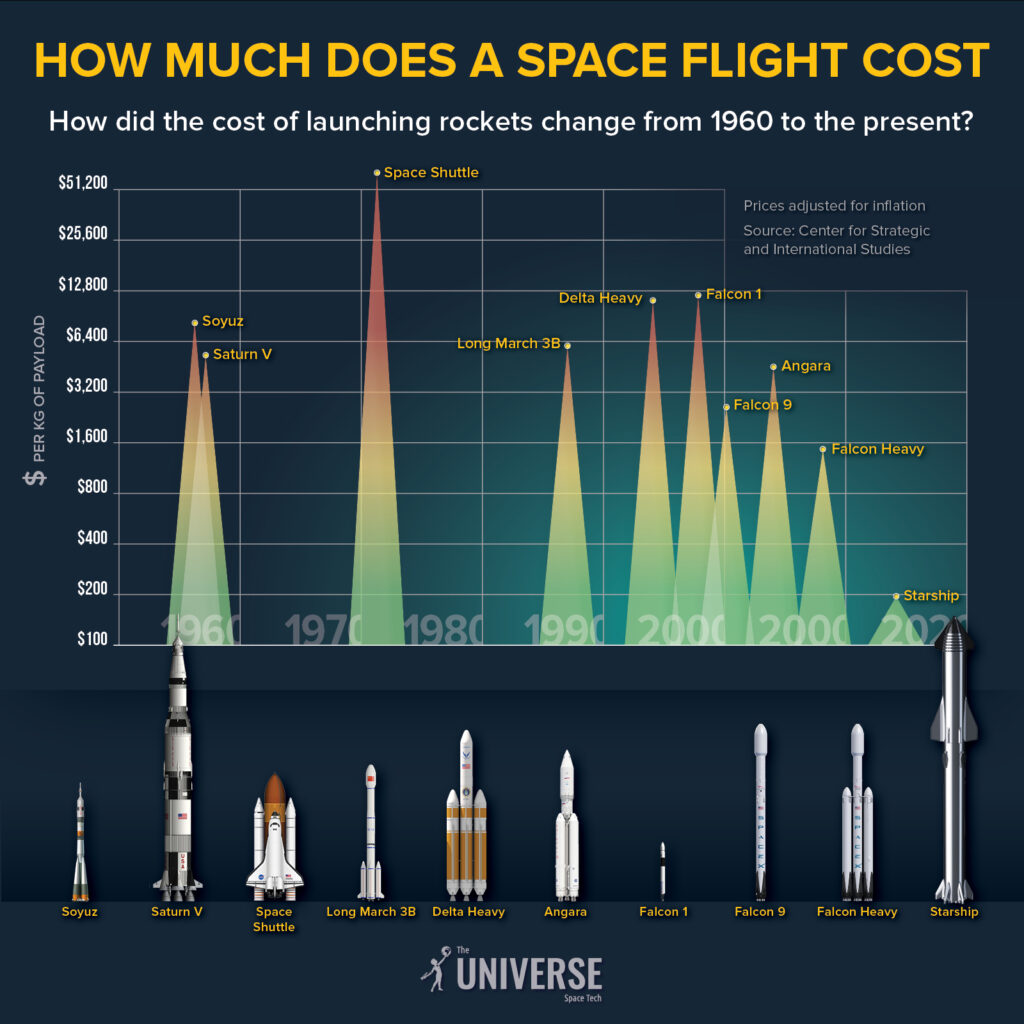

In the 1960s, NASA spent $28 billion on the Apollo program, equivalent to today’s $288 billion adjusted for inflation. However, over the past 20 years, space startups have proven their ability to compete with large aerospace contractors such as Boeing and Lockheed Martin. Today, the launch of a SpaceX rocket can be 97% cheaper than the cost of the flight of the Russian Soyuz spacecraft in the 1960s.

Private companies are interested in the design and construction of innovative spaceships that accelerate the delivery of people and cargo into space, making it more accessible. But how much does it cost to launch a cargo rocket and how has this cost changed over the years?

In the infographic, we see the cost of putting a kilogram of payload into orbit around the world since 1960, based on data from the Center for Strategic and International Studies. Currently, the cheapest delivery of a kilogram of cargo to low Earth orbit is provided by the SpaceX company: $2,100 for the Falcon 9 rocket and $1,400 for the Falcon Heavy.

In February of this year, Elon Musk announced that his company’s Starship craft and Super Heavy rocket (together called Starship) would revolutionize space exploration. They are a fully reusable transport system designed to deliver crews and cargo to Earth orbit, the Moon, Mars and beyond.

According to the idea of the creators, Starship will be able to rise to Earth orbit every 6-8 hours and bring more than 100 tons there in one flight. The Super Heavy rocket can be reused almost hourly. All this will make it possible to significantly reduce the cost of every launch. Elon Musk said: “In two or three years, I think it is very likely that the entire flight will cost less than 10 million dollars, and this is for 100 tons of cargo.” That is, the cost of lifting 1 kg into orbit will decrease to 100 dollars.

2. Space tourism

At the beginning of the second millennium, a new era in space exploration began — the first tourists flew into orbit. The cost of the first trip to the ISS was 20 million dollars. 2021 was a turning point for the development of space tourism. After many years of testing, several operators began to provide of tourist flights into space. Although competition has lowered the price of cargo flights, space transportation of people is still expensive. Only very rich people can afford a trip to orbit.

According to the forecast of the UBS investment bank, by 2030 the value of space tourism market will reach 3 billion dollars. One of the promising directions in this area is the use of suborbital devices for long-distance flights, for example, from London to Shanghai. SpaceX plans to replace airplanes with shuttles and reduce the time spent on the journey from 15 hours on the plane to 40 minutes on a spacecraft in the next ten years. However, UBS analysts note: for this business to become successful, companies will have to lower the price of such a flight to the price of a business class ticket or even lower to interest customers.

In addition to the high price, the development of the space tourism industry can be hindered by the limited market: sooner or later, everyone who wants and can afford it will have flown into space. Will these people want to spend the same amount of money again no repeat the trip?

Flight in zero gravity. The company Zero-G Experience offers a flight on a specialized Boeing 727 aircraft with short-term weightlessness for 8.6 thousand dollars.

Stratospheric tourism. The company Space Perspective offers a flight into the stratosphere for $125,000. For the same trip with World View, a tourist will pay only 50 thousand dollars, and with Zero 2 Infinity — approximately 130 thousand dollars.

Suborbital flight. Virgin Galactic charges $450,000 for a lift to the conventional boundary of the atmosphere, and Blue Origin — $500,000.

Orbital tourism. Real orbital flights around the Earth — on a much higher altitude — are much more expensive, fetching more than 50 million dollars per seat.

3. Satellite communication

Space tourism, of course, is one of the drivers of the industry, but the field of communication is much more profitable as for now. As of September 24, 2022, only SpaceX launched 3,397 Starlink satellites into orbit having performed 64 launches of the Falcon 9 launch vehicle.

According to a SkyQuest Technology Group report published in 2022, the global satellite communications (SATCOM) market last year was valued at $38.98 billion. According to the forecasts of this company, by 2028, at an average annual growth rate of 11.45%, it will reach 83.25 billion dollars. More and more players are planning to enter the global satellite communications market, so it is expected to grow enormously. This will be due to the growing demand for mobile broadband access, due to the growing sales of mobile devices and the popularity of Internet applications. Currently, the market is dominated by several private companies, mainly Starlink, Oneweb, SES, Intelsat, Telesat and Viasat.

The Union of Concerned Scientists (UCS) determined that in April 2022 there were 5,465 active satellites orbiting the globe. Of them, 3,433 belong to the USA, 541 to China, 172 to Russia, and 1,319 to other countries. Western countries have achieved the greatest success in the global satellite communications market. China has one of the highest growth rates, while Russia, Europe and Canada are turning their international operations into local successes. According to Euroconsult estimates, 990 satellites will be launched annually in the next decade. This means that by 2028 there may be 15,000 operating devices in orbit.

4. RS satellites

The satellite market makes up the largest part of the space economy, more than 70%. This is stated in an extensive report published by Citigroup in May 2022. While satellite revenues mainly come from services such as television, there is another financially promising sector. We are talking about satellite imagery, which the firm estimates at $2.6 billion dollars, or about 2%, of the current space economy. Satellites of remote sensing of the Earth (RS) provide environmental monitoring and protection, resource management, humanitarian response and sustainable development.

According to Straits Research, the global Earth observation satellite market was valued at $3.58 billion in 2021 and is forecasted to reach $7.88 billion by 2030, growing at an average rate of 6.87% between 2022 and 2030. According to UCS, the leading operators on the market are commercial companies: Planet, Spire Global and BlackSky Global are American companies; Chang Guang Satellite Technology Company is a Chinese company; Satellogic is an Argentine company; ICEYE ltd is a Finnish company. They control almost 55% of the world’s active satellites.

5. Service companies

Over the past decade, many new private players have entered the space arena, and more and more companies are joining them with new ideas. Among them are using 3D-printing technology in zero gravity, the deployment of greenhouses on Mars, or mineralogical research on the Moon.

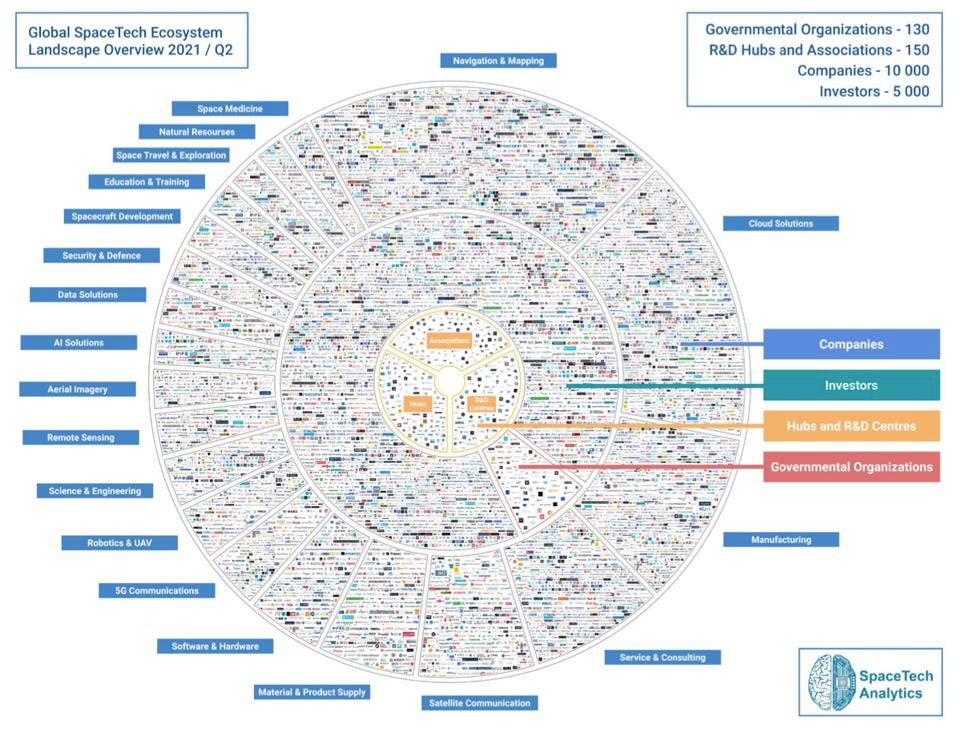

According to the Space Tech Analytics report for 2021, there are now 5,582 space companies in the United States. This is almost ten times more than in the next country by this indicator — Great Britain, where there are 615 of them. The competition between them led to the fact that the total value of space-oriented companies exceeded the 4 trillion dollar mark for the first time and became a key factor in the decrease in cost of launches into orbit by almost two orders of magnitude over the past 20 years. All over the world, the following the space services market looks as follows:

- 10,000+ private space technology companies

- 5,000 large investors

- 150 research and development centers

- 130 state organizations

- 20 business sectors — from navigation and cartography to space medicine

Most of these private companies are grouped in only five sectors. Navigation and mapping are the largest: 2,820 companies are engaged in them. They are followed by cloud solutions — 2,406 and production — 1,048.

According to Space Capital’s quarterly report, which tracks 1,700 organizations, in 2021 companies of space infrastructure received 14.5 billion dollars of private investments. And it was not the best year, for the world economy suffered the consequences of the COVID-19 pandemic. There is no doubt that after the world overcomes the negative factors associated with the full-scale invasion of Russia into Ukraine, space investment will increase in a swift and powerful manner.